Every year the College Board releases its annual Trends in College Pricing report that highlights current college costs and trends.

While costs can vary significantly depending on the region and college, the College Board publishes average cost figures, which are based on its survey of nearly 4,000 colleges across the country.

Following are cost highlights for the 2015/2016 academic year. Total average cost figures include tuition and fees, room and board, and a sum for books, transportation, and personal expenses. Together, these expenditures are officially referred to by colleges as the “total cost of attendance.”

Public colleges (in-state students)

- Tuition and fees increased an average of 2.9% to $9,410

- Room and board increased an average of 3.6% to $10,138

- Total average cost* for 2015/2016: $24,061 ($23,410 in 2014/2015)

Public colleges (out-of-state students)

- Tuition and fees increased an average of 3.4% to $23,893

- Room and board increased an average of 3.6% to $10,138

- Total average cost* for 2015/2016: $38,544 ($37,229 in 2014/2015)

Private colleges

- Tuition and fees increased an average of 3.6% to $32,405

- Room and board increased an average of 3.2% to $11,516

- Total average cost* for 2015/2016: $47,831 ($46,272 in 2014/2015)

Keep in mind that these are average cost figures. The total cost for the most selective private colleges is substantially higher–over $65,000 per year.

New FAFSA timeline

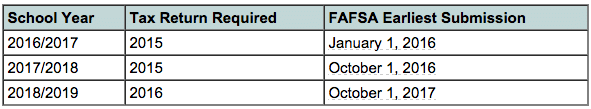

Starting with the 2017/2018 academic year, families will be able to file the Free Application for Federal Student Aid, or FAFSA, as early as October 1, 2016 rather than after January 1, 2017. The intent behind the new timeline is to better align the financial aid process with the college admission process and to provide families with specific information on aid eligibility earlier in the process so they can make more informed college financial decisions.

One of the effects of this new timeline is that your 2015 federal tax return will do double duty as an income reference point for aid eligibility. Specifically, your 2015 tax return will be the basis for the FAFSA for two school years–2016/2017 and 2017/2018. For the 2016/17 school year, the FAFSA can be filed anytime after January 1, 2016 and will use your 2015 tax return information, and for the 2017/2018 school year the FAFSA can be filed as early as October 2016 and will also use your 2015 tax return information.

Potential steps to take

If you can reduce your income before the end of 2015, you could lower your expected family contribution, or EFC, and potentially increase your child’s financial aid award two years in a row. That’s because your income, not assets, is the biggest factor in determining the amount of financial aid you’ll receive. According to financial aid expert Mark Kantrowitz, every $10,000 increase in parent income generally results in an approximate $3,000 decrease in need-based financial aid.

Many parents have no control over how or when they get paid by their employer. But you might be able to hold off on certain actions that would increase your income, for example, taking distributions from retirement plans, realizing capital gains, or receiving a bonus–this money will all count as income on the FAFSA. On the flip side, parents who think they can lower their income by increasing their pre-tax contributions to retirement accounts should think again–the FAFSA will count these discretionary contributions as income.

In addition, even though assets aren’t counted as heavily as income, the FAFSA still considers up to 5.6% of a parent’s assets to be available for college. So if you have some funds sitting around that are earmarked for a larger purchase, consider making that purchase before you file the FAFSA.

New REPAYE Plan for student loans

In other college news, the pool of borrowers eligible for the current Pay As You Earn Plan for student loan repayment has been expanded. The new plan, called the REPAYE Plan (Revised Pay As You Earn), will be available to all borrowers with federal direct loans, regardless of when students took out the loans (the original Pay As You Earn Plan is available only to borrowers who took out loans after 2007).

Under the REPAYE Plan, monthly loan payments will be capped at 10% of a borrower’s discretionary income, with any remaining debt forgiven after 20 years of on-time payments for undergraduate borrowers and after 25 years of on-time payments for graduate school borrowers.

The REPAYE Plan will be available to borrowers starting in mid-December 2015. The federal government is in the process of updating its website (studentaid.gov) to reflect the new REPAYE Plan, but you can go there to learn more about income-driven student loan repayment options in general.