There’s still time to make a regular IRA contribution for 2015

You have until your tax return due date (not including extensions) to contribute up to $5,500 for 2015 ($6,500 if you were age 50 by December 31, 2015). For most taxpayers, the contribution deadline for 2015 is April 18, 2016 (April 19, 2016, if you live in Maine or Massachusetts).

You can contribute to a traditional IRA, a Roth IRA, or both, as long as your total contributions don’t exceed the annual limit (or, if less, 100% of your earned income). You may also be able to contribute to an IRA for your spouse for 2015, even if your spouse didn’t have any 2015 income.

Traditional IRA

You can contribute to a traditional IRA for 2015 if you had taxable compensation and you were not age 70½ by December 31, 2015.

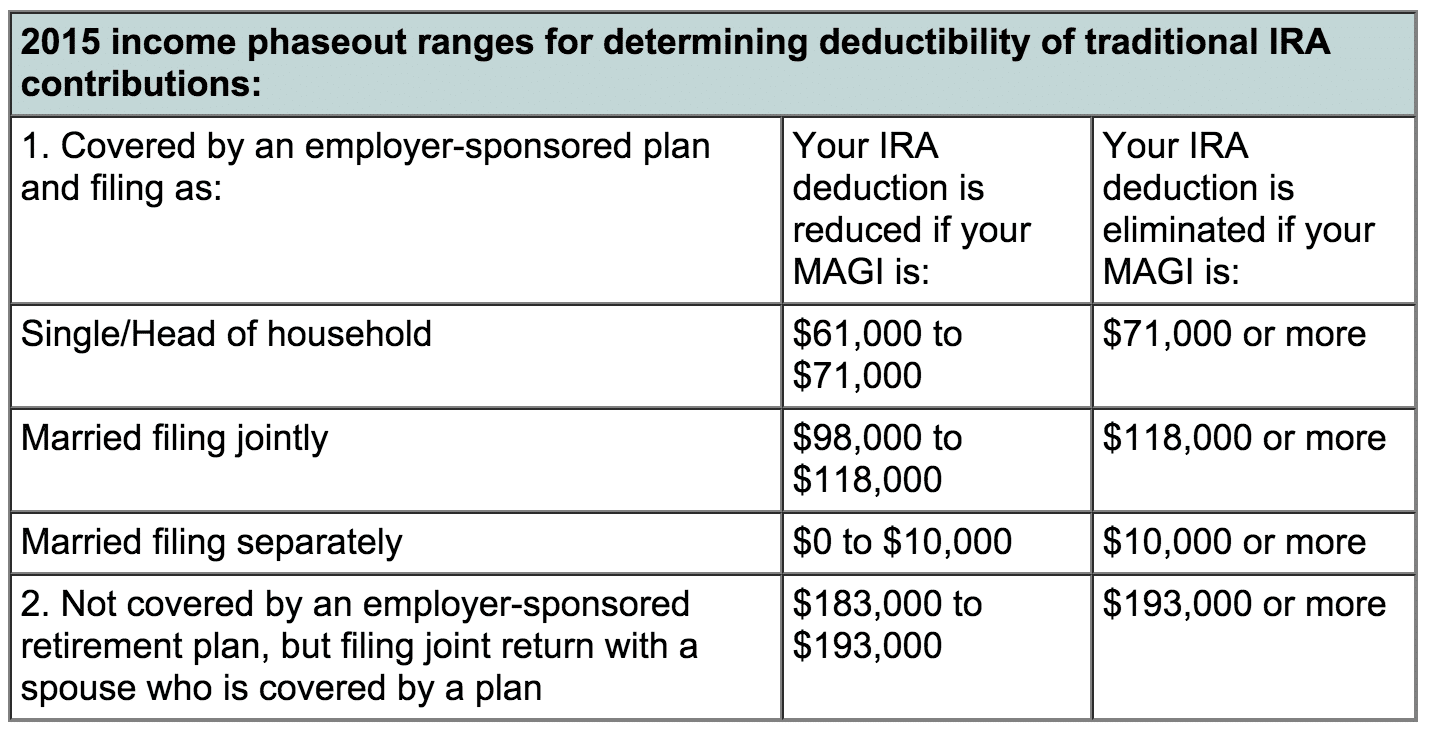

However, if you or your spouse was covered by an employer-sponsored retirement plan in 2015, then your ability to deduct your contributions may be limited or eliminated depending on your filing status and your modified adjusted gross income (MAGI) (see table below). Even if you can’t deduct your traditional IRA contribution, you can always make nondeductible (after-tax) contributions to a traditional IRA, regardless of your income level.

However, in most cases, if you’re eligible, you’ll be better off contributing to a Roth IRA instead of making nondeductible contributions to a traditional IRA.

Roth IRA

You can contribute to a Roth IRA if your MAGI is within certain dollar limits (even if you’re 70½ or older). For 2015, if you file your federal tax return as single or head of household, you can make a full Roth contribution if your income is $116,000 or less. Your maximum contribution is phased out if your income is between $116,000 and $131,000, and you can’t contribute at all if your income is $131,000 or more. Similarly, if you’re married and file a joint federal tax return, you can make a full Roth contribution if your income is $183,000 or less. Your contribution is phased out if your income is between $183,000 and $193,000, and you can’t contribute at all if your income is $193,000 or more. And if you’re married filing separately, your contribution phases out with any income over $0, and you can’t contribute at all if your income is $10,000 or more.

Even if you can’t make an annual contribution to a Roth IRA because of the income limits, there’s an easy workaround. If you haven’t yet reached age 70½, you can simply make a nondeductible contribution to a traditional IRA, and then immediately convert that traditional IRA to a Roth IRA. Keep in mind, however, that you’ll need to aggregate all traditional IRAs and SEP/SIMPLE IRAs you own–other than IRAs you’ve inherited–when you calculate the taxable portion of your conversion. (This is sometimes called a “back-door” Roth IRA.)

Finally, keep in mind that if you make a contribution to a Roth IRA for 2015–no matter how small–by your tax return due date, and this is your first Roth IRA contribution, your five-year holding period for identifying qualified distributions from all your Roth IRAs (other than inherited accounts) will start on January 1, 2015.